pa auto sales tax rate

Some states provide official vehicle registration fee. Once you have that number multiply it by 6 to get the cost of the state sales tax on your new vehicle.

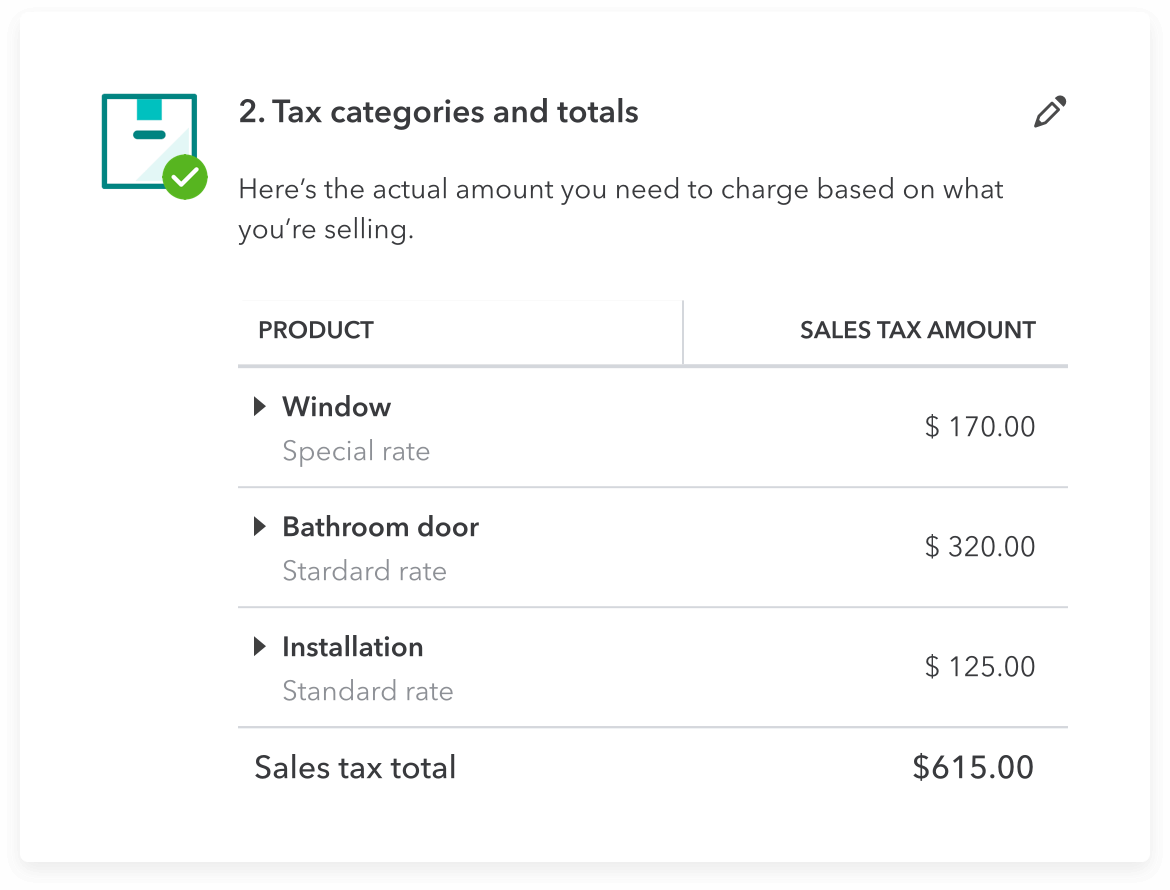

Sales Tax Software For Small Business Quickbooks

31 rows The state sales tax rate in Pennsylvania is 6000.

. With local taxes the total sales tax rate is between 6000 and 8000. Calculating Sales Tax Summary. Nine-digit Federal Employer Identification.

Calculate Sales Tax in Pennsylvania Example. Eight-digit Sales Tax Account ID Number. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. The Pennsylvania sales tax rate is currently 6. Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of.

The following is what you will need to use TeleFile for salesuse tax. Statutory or regulatory changes judicial decisions or different facts may modify or negate the tax determinations as indicated. 1 percent for Allegheny County 2 percent for Philadelphia.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. For example if a vehicle rental is 100 figure. Well get you in the perfect car truck or SUV for your lifestyle.

Pennsylvania Vehicle Registration Taxes Fees. The minimum combined 2022 sales tax rate for Easton Pennsylvania is 6. Lowest sales tax 6 Highest sales tax 8 Pennsylvania Sales Tax.

Some dealerships may also charge a 113 dollar document preparation charge. Maximum Local Sales Tax. Though many states calculate taxes on the sales price before any dealer incentives or credits are applied its just the opposite in Pennsylvania sales taxes are.

775 for vehicle over. Call Sales Phone Number 215-330-0539 Service. Effective October 30 2017 a prorated partial day fee for carsharing services was.

When figuring the tax do not tax one tax with another. With local taxes the total sales tax rate is. Construction Contractors Guide for Building Machinery and Equipment.

PA Sales Use and Hotel Occupancy Tax. Farming REV-1729 Mushroom Farming. 260 per pack of 20 cigaretteslittle cigars.

Medical and Surgical Supplies. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny.

635 for vehicle 50k or less. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. Some examples of items that exempt from Pennsylvania.

Pennsylvania State Sales Tax. The taxes are in addition to sales and use tax and other taxes levied on vehicle rentals. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

After the title is transferred the seller must remove the license plate. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. Maximum Possible Sales Tax.

The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Average Local State Sales Tax. At PA Auto Sales we finance everyone.

1795 rows 2022 List of Pennsylvania Local Sales Tax Rates.

Pennsylvania Sales Tax Guide And Calculator 2022 Taxjar

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota

A Complete Guide On Car Sales Tax By State Shift

Understanding California S Sales Tax

Virginia Sales Tax On Cars Everything You Need To Know

Illinois Sales Taxes Parking Excise Tax Exemptions Enacted Ansari Law Firm

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Which U S States Charge Property Taxes For Cars Mansion Global

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Fuel Taxes In The United States Wikipedia

Form Rev 227 Fillable Pa Sales And Use Tax Credit Chart Rev 227

Used Car Prices Catch Wall Street S Eye As A Predictor Of Inflation The New York Times

Do You Pay Sales Tax On A Car Down Payment Green Light Auto Credit

Understanding California S Sales Tax

How Is Sales Tax Calculated On A Vehicle Lease In Pennsylvania Sapling

Historical Pennsylvania Tax Policy Information Ballotpedia

Form Rev 227 Fillable Pa Sales And Use Tax Credit Chart Rev 227